What Is The Interest Rate On A Home Loan

Mortgage rates are determined based on your credit score the loan to value ratio of the home and the type of loan youre applying for.

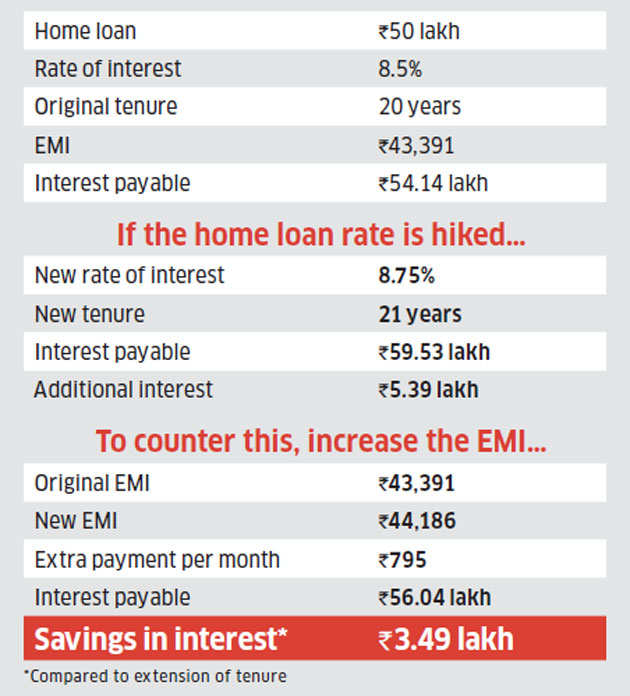

What is the interest rate on a home loan. Heres how these work in a home mortgage. So for example if youre making monthly payments divide by 12. The reduction of repo rates will see home loan interest rates fall below 8. Bankrate helps you compare current home mortgage refinance interest rates.

If you know how to calculate interest rates you will better understand your loan contract with your bank. Divide your interest rate by the number of payments youll make in the year interest rates are expressed annually. Multiply it by the balance of your loan which for the first payment will be your whole principal amount. You also will be in a better position to negotiate your interest rate.

Interest rate will change under defined conditions also called a variable rate or hybrid loan. For example a 12 annual rate becomes a 1 monthly rate. When a bank quotes you an interest rate its quoting whats called the effective rate of interest also known as the annual percentage rate apr. In the upcoming policy review that is scheduled on 5 december 2019 the reserve bank of india rbi is expected to reduce the repo rate by 25 basis points.

For example a 12 annual rate becomes a 1 monthly rate. In general homebuyers with good credit scores of 740 or higher can expect lower interest rates and more options including jumbo loans. The apr is different than the stated rate of interest due to the. Your rate will also be calculated based on the loan to value ratio which considers the percentage of the homes value.

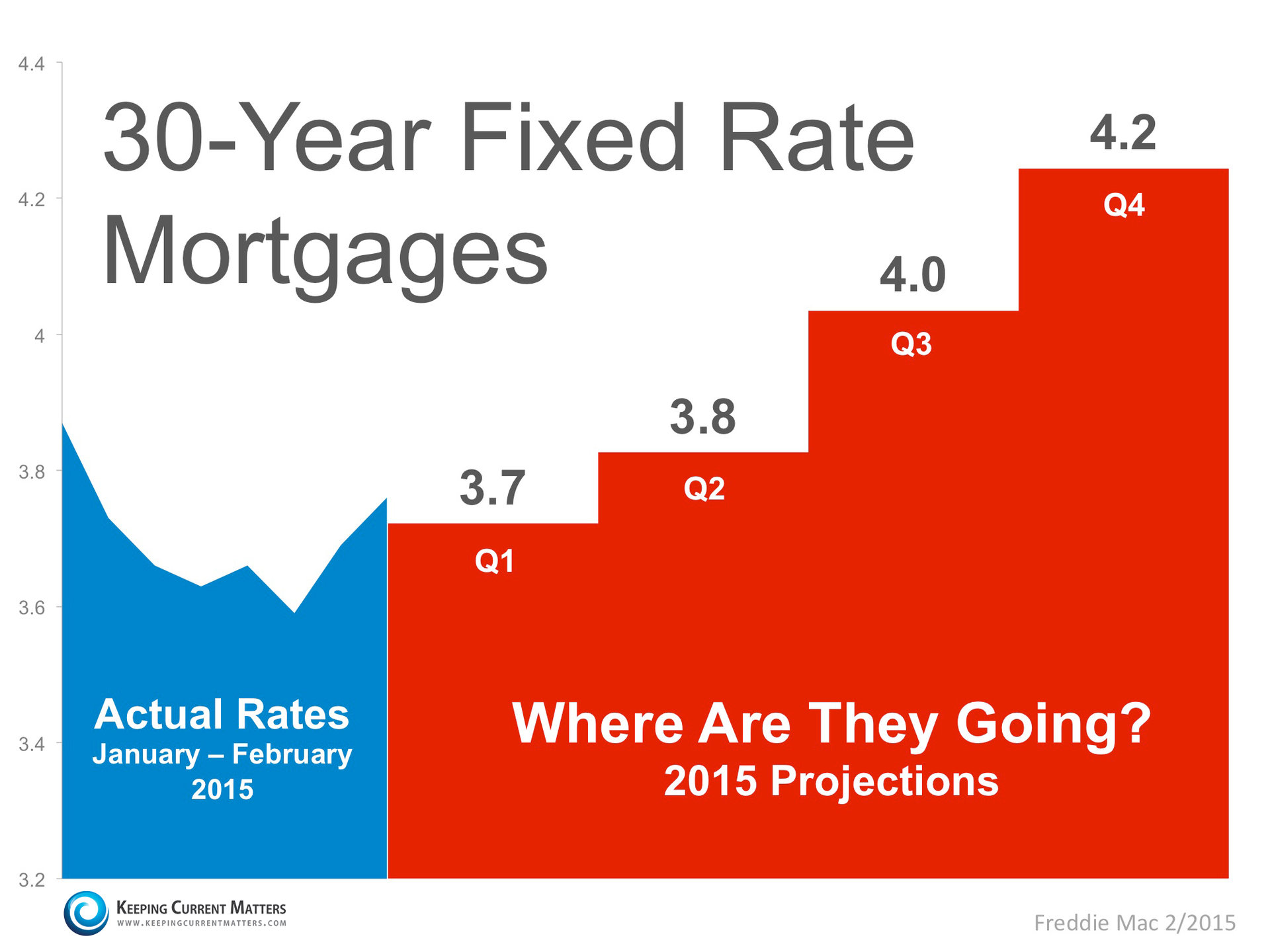

Even a slight difference in rates can drive your monthly payments up or down and you could pay thousands of. Rate of interest on home loans may reduce below 8 soon.