Refinance Home Loan Calculator

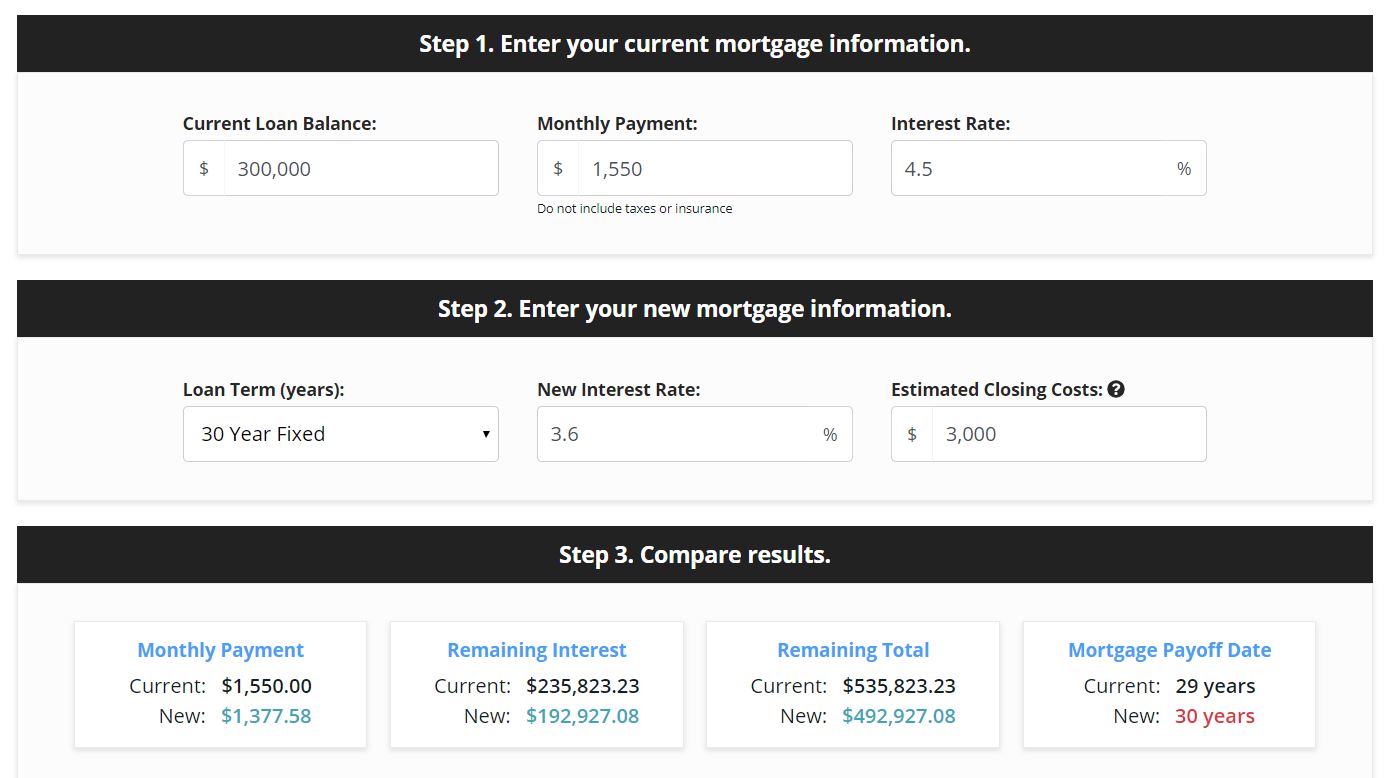

Bankrates mortgage refinance calculator will give you an idea of how much you stand to save or lose.

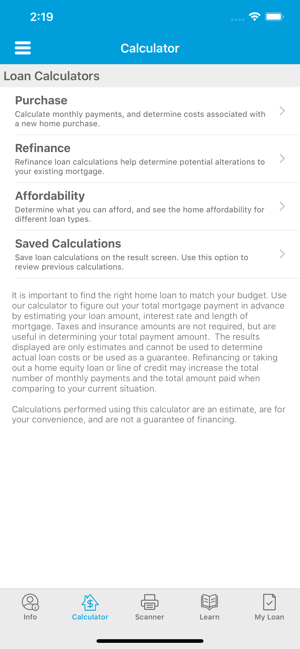

Refinance home loan calculator. This calculator has a years before sell setting which is used to run both loans from present until that date. The loan term is the period of time during which a loan must be repaid. This calculator is for homeowners who are looking to make a strictly economic decision in terms of which loan will be better based upon comparing the interest expense and home equity against the closing costs associated with refinancing their home. Includes taxes insurance pmi and the latest mortgage rates.

If you do not plan on selling the. Estimate your new monthly mortgage payment savings and breakeven point. Use our additional payment calculator to see how much you could save on your total bond costs by paying extra into your home loan. Mortgage refinancing is replacing your current home loan.

By using the refinance calculator and selecting pay my loan off faster as his goal nick learns that by switching to a home loan with a lower interest rate of 379 per cent but continuing to pay 1881 per month he could potentially repay his loan 32 years sooner and save 112800 in total interest charges. Estimate your new monthly mortgage payment savings and breakeven point. If youd like to take out a new bond on your existing bond free home in order to access cash out of the property use this calculator to see what your expected repayment would be. This loan calculator will help you determine the monthly payments on a loan.

What is mortgage refinancing. Use our free mortgage calculator to quickly estimate what your new home will cost. Try our easy to use refinance calculator and see if you could save by refinancing. Simply enter the loan amount term and interest rate in the fields below and click calculate to calculate your monthly.

Calculate how much money you could potentially save by refinancing your home loan with the iselect home loan refinancing calculator.