Home Equity Loan Calculator Chase

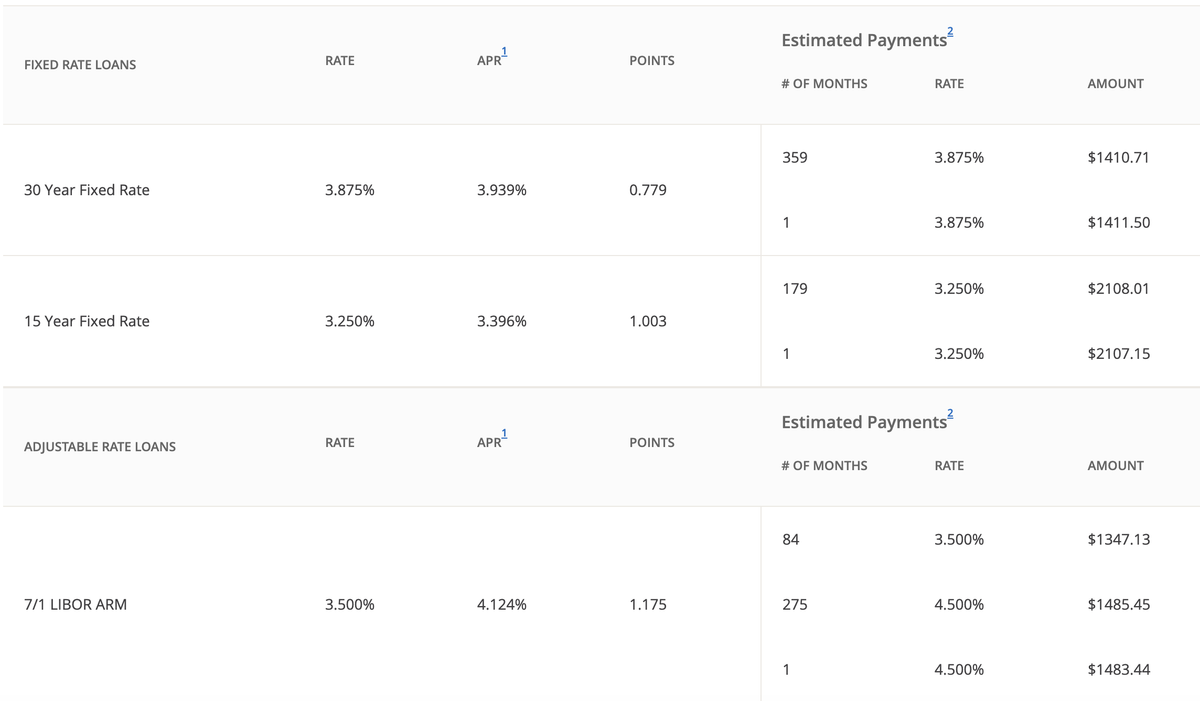

The chase home equity line of credit features variable rates based on the prime rate as published in the wall street journal which as of 432020 range from 375 apr to 626 apr for line amounts of 50000 to 99999 from 375 apr to 551 apr for line amounts of 100000 to 149999 from 375 apr to 551.

Home equity loan calculator chase. How to calculate home equity. Our home equity line of credit lets you use a homes equity to pay for home improvements or other expenses. As a reminder there are steps youre required to take. Before you apply for a heloc see our home equity rates check your eligibility and use our heloc calculator plus other heloc tools.

Tap into equity use the equity in your home to make your plans a reality. You can take out a home equity loan which has a fixed rate and use this new loan to pay off the heloc. Chase has home mortgage and jumbo loan options to purchase a new house or to refinance an existing one. As a reminder there are steps youre required to take.

Get started online or speak to a chase home lending advisor. With a chase home equity line of credit heloc you can use your homes equity for home improvements debt consolidation or other expenses. Before you apply for a heloc see our home equity rates check your eligibility and use our heloc calculator plus other heloc tools. Before you apply for a heloc see our home equity rates check your eligibility and use our heloc calculator plus other heloc tools.

Simply enter the home price your down payment the property zip code your credit score and whats most important to you when choosing a loan. With a chase home equity line of credit heloc you can use your homes equity for home improvements debt consolidation or other expenses. The advantage of doing this is that you could dodge those rate. You can choose to pay off a heloc and close your home equity line of credit account at any time.